As the world grapples with the unfolding COVID-19 pandemic, insurers are experiencing an urgent need to identify ways to free up cash and maintain their operations, while continuing to deliver an exceptional experience to policyholders.

As a result of COVID-19, operations are constrained, workers have been forced to stay home, supply chains are broken, and policyholders are scared.

Embracing technology can uniquely help insurers address the challenges of COVID-19. It can play an important role in enabling insurers to adapt their operations to the new realities brought on by the pandemic as well as providing tools for managing cash flow, risks and customer relationships.

It is for these reasons that insurers should prioritize deploying an omni-channel payment solution – a single cloud-based platform for managing inbound and outbound check and electronic payments.

The Benefits of an Omni-Channel Payment Solution during the Pandemic

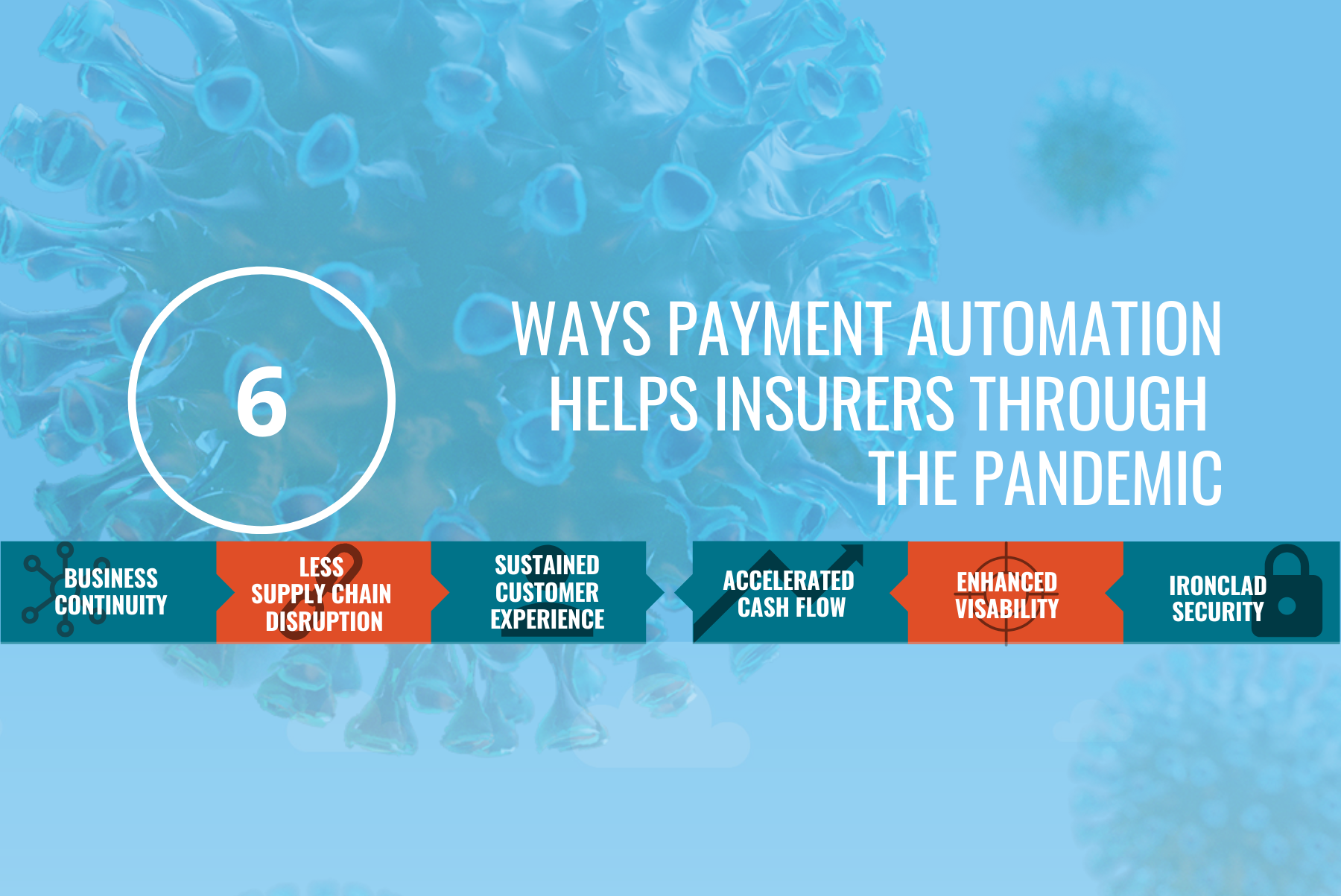

Omni-channel payment solutions uniquely address the challenges of COVID-19 in six critical ways:

1. Business continuity

Work-from-home mandates are disrupting core financial operations such as disbursements and accounts receivables. There is no end in sight to telecommuting and remote business activity. The unknown timetable for staff to return to the office poses big challenges for initiating and processing payments.

If employees are out of the office due to government mandates, quarantines or illness, there is no telling when checks will get cut or deposited. These inevitable delays in payment processing could have a large impact on an insurer’s cash flow, supply chains, staff and contractors.

Omni-channel payment solutions eliminate the need for employees to be in the office to cut or deposit checks.

Authorized users can securely initiate or process electronic payments from anywhere. For instance, insurers can initiate disbursements by uploading a single file to a secure cloud.

Omni-channel payment solutions also help ensure that employees and contractors get paid during work-from-mandates; payments can be made via a reloadable debit card that the recipient can easily link to their primary bank account. An omni-channel payment solution also enables insurers to make instant payments to employees for bonuses during the pandemic. Best of all, an omni-channel payment solution can be deployed fast, with hardly any IT involvement.

2. Less supply chain disruption

The financial upheaval caused by COVID-19 is putting a tremendous strain on cash flows. Small and midsized businesses, particularly, have seen their receivables stretched bare. An omni-channel payment solution offers an antidote to pain for cash-strapped suppliers.

Payments made via ACH+ and virtual cards arrive much faster than check payments, and there’s no chance of a delay if an insurer’s employees cannot make it into the office. Instant payments can even arrive within seconds of being initiated. And electronic payments made via an omni-channel payment solution arrive with rich remittance detail that makes it easy for suppliers to reconcile payments and manage their cash flow.

3. Sustained customer experience

With employees likely to be working from home for the foreseeable future, insurers will have to figure out ways to pay claims without going into the office. In an environment with a constrained workforce, insurers that pay claims with paper checks will likely end up with long processing times, causing a poor customer experience.

An omni-channel payment solution enables insurers to make claims payments electronically using Real-Time Payments (RTP), instant payments and reloadable debit cards – everything an insurer wants in a payment method, only faster. What’s more, authorized users working from home can securely initiate electronic claims payments. Not only does this encourage social distancing, it improves efficiency and delights policyholders who are making a claim.

4. Accelerated cash flow

Extended periods of workplace closures will likely impact an insurer’s ability to deposit check payments from policyholders. Bank lockbox operations may also be disrupted. Omni-channel payment solutions provide insurers with the capabilities to confidently encourage electronic payments rather than check payments.

Omni-channel payment solutions offer policyholders the flexibility to make payments using their preferred method. Receiving more payments electronically will accelerate the payment and collection stream and help reduce the administrative burden for accounts receivable.

5. Enhanced visibility

COVID-19 will likely affect the financial strength of insurers. Closely monitoring cash flow and corporate spending will be instrumental to cash forecasting and planning in the months and years ahead. Omni-channel payment solutions have built-in data analytics tools that help insurers make sense of their disbursements and receivables. Omni-channel payment solutions also incorporate real-time visibility into the status of payments, which can facilitate better financial decision-making during tumultuous economic times.

6. Ironclad security

Bad actors thrive in times of chaos and uncertainty. Work-from-home arrangements don’t mean finance operations have to forego their security and data protection standards. Omni-channel payment solutions safeguard an insurer’s data and business processes with configurable access controls, strong user authentication, secure connectivity, separation of duties, comprehensive audit logging and managed security monitoring. These hardened controls uniquely address the problem of finance employees working remotely.

Maintain Business-Critical Processes

COVID-19 is creating unprecedented business constraints for insurers. Omni-channel payment solutions provide insurers with an opportunity to address the problems caused by COVID-19, to maintain business-critical payments processes and equip the business to succeed during the recovery.

Want to learn how an omni-channel payment solution can benefit your insurance company?