Imagine if your business could receive payments as scheduled.

Imagine if you could get paid according to your payment preferences.

Imagine if you never had to key data, match payments to remittances, or reconcile payments.

And imagine if you never had to worry about your banking details falling into the wrong hands.

A new approach to business-to-business (B2B) payments is making this vision a reality by simplifying and automating the exchange of payments-related data between buyers and sellers.

Friction in the B2B Payments Lifecycle

Approximately $22 trillion in B2B payments will be transacted in North America this year.

Despite the high stakes, the way that businesses pay and get paid has a lot of room for improvement.

Outdated, inefficient processes are still the norm in B2B payments. For starters, spreadsheets are the payments reporting tool of choice in many businesses. Even in the digital era, businesses of all sizes use spreadsheets to manage payment terms and manually reconcile invoices, studies show.

Payment processes also are very inefficient. Thirty percent of accounts payable employee time is spent on answering accounts payable-related questions and other manual tasks. Inefficiencies in payment processing also cause lots of supply chain issues.

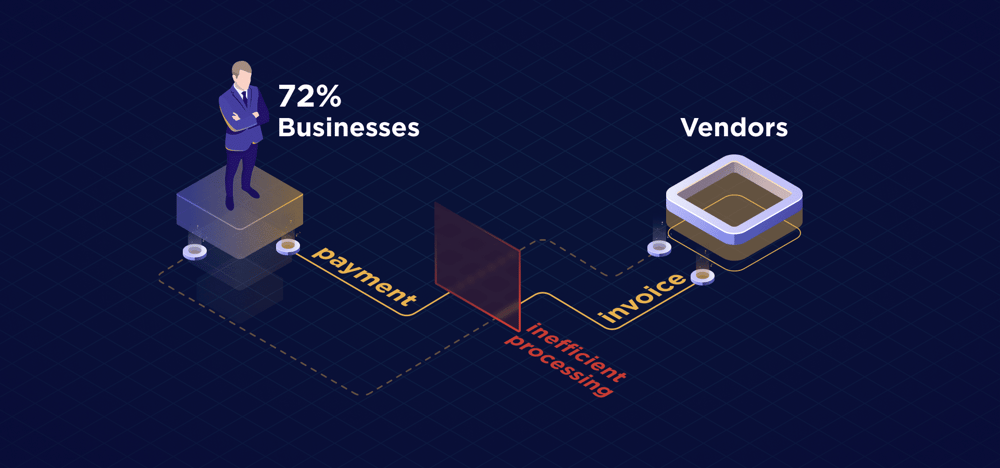

72% of Businesses

experience stress, delivery delays and damage to vendor relationships because of inefficient invoice and payment processing.

And the proliferation of payment methods is making things harder.

Suppliers must contend with multiple payment and data silos. In fact, the decline in check volume is creating greater complexity for those suppliers that rely on standalone payment systems. Difficulty in processing all these different payment types and their data creates cash application challenges.

Thirty-five percent of suppliers manually reconcile more than 40 percent of their invoices.

Businesses also face lots of risk in their payment processes. And the operational disruption caused by the sudden shift to remote working is exposing and exacerbating vulnerabilities in B2B payments. Businesses have reported $3 billion in total losses from Business E-mail Compromise (BEC).

What is more, payment processing inefficiencies are big contributor to late payments.

Rethinking B2B Payments

Clearly the B2B payments lifecycle needs a re-do.

On the surface, B2B payments do not seem that hard.

- A supplier creates an invoice and sends it to a customer

- A customer approves the invoice and initiates a payment

- The payment and some remittance data are sent to the supplier

- The payment is deposited in the supplier’s bank account

- The remittance information is matched and reconciled against open invoices

The reality in B2B payments is significantly different.

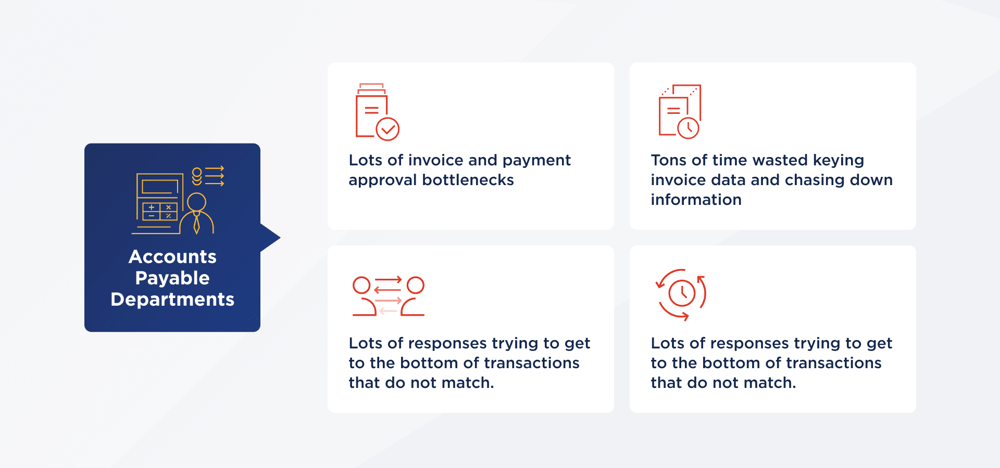

Accounts payable departments face:

- Lots of invoice and payment approval bottlenecks

- Tons of time wasted keying invoice data and chasing down information

- Headaches trying to match invoices to purchase orders – and back-and-forth e-mails and phone calls trying to get to the bottom of transactions that do not match

- Long invoice approval cycles that result in late payment penalties and supplier inquiries

Things are not much better for accounts receivable departments:

- Late and incorrect payments are common

- There is no telling whether suppliers will receive the remittance information they need

- Suppliers often must call and e-mail customers for clarification about payments

- Applying payments is burdensome

In short, B2B payments have too many manual processes and aren't transparent enough.

In short, B2B payments have too many manual processes and aren't transparent enough.

How this could be, you might be wondering?

After all, your company has probably invested big bucks in a world-class ERP or automated procure-to-pay or order-to-cash systems.

Blame it on the closed-loop networks and bilateral integration that businesses have historically relied on to automate their B2B payments, as well as the point solutions each with unique:

- Logins and passwords

- Account requirements

- File formats

- Proprietary integrations

The result is lots of payment and data silos. And that causes:

- Back-and-forth phone calls, e-mails, and faxes

- Limited remittance details

- Time wasted keying data, chasing down information and shuffling paper

Consider the portals that many businesses have deployed to try and facilitate B2B transactions. Seventy-four percent of suppliers say that spending less time logging into buyer portals to download remittance data as “very important” or “extremely important,” studies show.

Low quality remittance data is a particularly big problem in B2B payments. Chances are your accounts receivable department is keying – or paying someone to key – a lot of your remittance data

Many accounts receivable departments waste a lot of time chasing down remittance data.

61% of ACH transactions have remittance data that is sent separately from the payment.

Treasury professionals recognize the problems with making and receiving B2B payments. Sixty percent of them say manual processing is their top challenge.

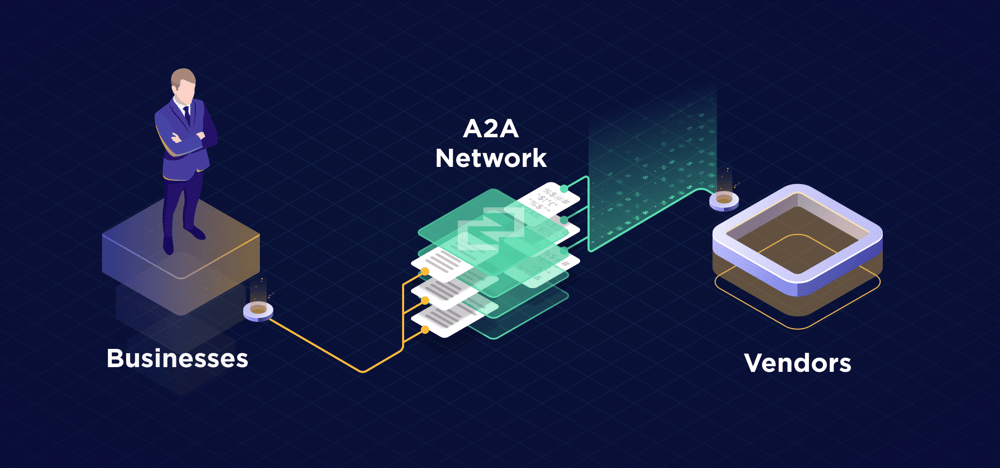

Enter A2A Automation

A2A automation makes B2B payments less costly, less complex, and less risky.

An A2A solution enables buyers and suppliers to systematically connect to each other and share payment data using common rules and standards. This is a game changer in B2B payments. Among other benefits, it will enable the passage of remittance data, reduce late payments and mitigate risks.

An A2A solution uses a single platform that combines:

- Electronic payments functionality, such as Real-Time Payments (RTP)

- Accounts payable and accounts receivable invoicing

- ERP integration

- And payment services

The RTP network facilitates the immediate transmission and settlement of payments and the exchange of standardized and enhanced remittance data.

Invoicing capabilities enable suppliers to instantly present invoices via an e-invoice 24/7/365 for initial or recurring bills in a customer’s preferred online or mobile banking channel.

ERP integration connects buyers and sellers and facilitates the exchange of data without the burden of a costly and resource-intensive project.

Rich, real-time data exchanges streamline payment reconciliation. And payment services manage a directory of trading partners, payment terms and preferences, standard reconciliation information, and banking accounts details.

The information typically required to send electronic payments (i.e. the bank routing number and account number) is not always readily available.

Payment services remove this barrier to electronic payments. An A2A automation gives businesses the ability to automate payments without the need to share sensitive bank account information.

All this has big implications for buyers and sellers alike.

- Suppliers can receive remittance data for reconciliation in a standard format

- Suppliers can spend less time logging into buyer portals and resolving exceptions

- Suppliers can systematically apply payment terms

- Buyers can effortlessly pay suppliers without having to log into a portal

- Buyers can optimize opportunities to make electronic payments

- Buyers receive fewer calls and e-mails from suppliers regarding payment status

- Buyers spend less time processing invoices and paying suppliers

This radically changes applications where cash is paid upon delivery. Goods are delivered from a distributor to a retailer. An electronic invoice is presenter to the retailer. The retailer can use a mobile device to approve the invoice. That triggers a request for payment from the distributor’s bank to the retailer’s bank.

An RTP is then initiated and the payment is instantly confirmed, received, and reconciled, all without any manual data entry, chasing down information, or shuffling paper.

This is music to a treasurer’s ears.

Thirty-four percent of treasurers say their corporation plans to invest in accounts receivable and accounts payable improvements. They want to reduce friction in their B2B payments lifecycle.

Does your business want to eliminate friction from B2B payments?