This is the era of user centric B2B payments.

Until recently, all but the largest buyers had to submit to a supplier’s payments process. Suppliers could never be sure what remittance details, if any, they would receive. And the process of making and receiving and reconciling payments was a time-consuming manual burden for everyone involved.

But our experiences as consumers have changed the expectations for B2B payments. In our always-on economy, a meal can be delivered right to our front door, a car will pick us up within minutes, a bestselling book can be instantly downloaded, and we can book an exotic vacation with a few clicks.

And we can do all this with little effort or hassle.

❕ Think about your recent purchases from Amazon, Apple, Grub Hub, Uber, Spotify, and Expedia.

Payments are critical to a seamless customer experience. Consumers can pay using their preferred format. They don’t have to log into another system to make a payment. There is no need for back-and-forth e-mails to make a purchase. They can instantly see the status of their order and payment.

Why can’t B2B payments work that way?

In most businesses, B2B payments are managed through a hodgepodge of standalone point solutions with unique logins and passwords, accounts requirements, file formats, and proprietary integrations. This antiquated approach to making and receiving payments is lots and lots of paper, and increased workload, high AP and AR costs, sky-high Day’s Sales Outstanding (DSO), and customer churn.

A new breed of embedded payments solution is changing things.

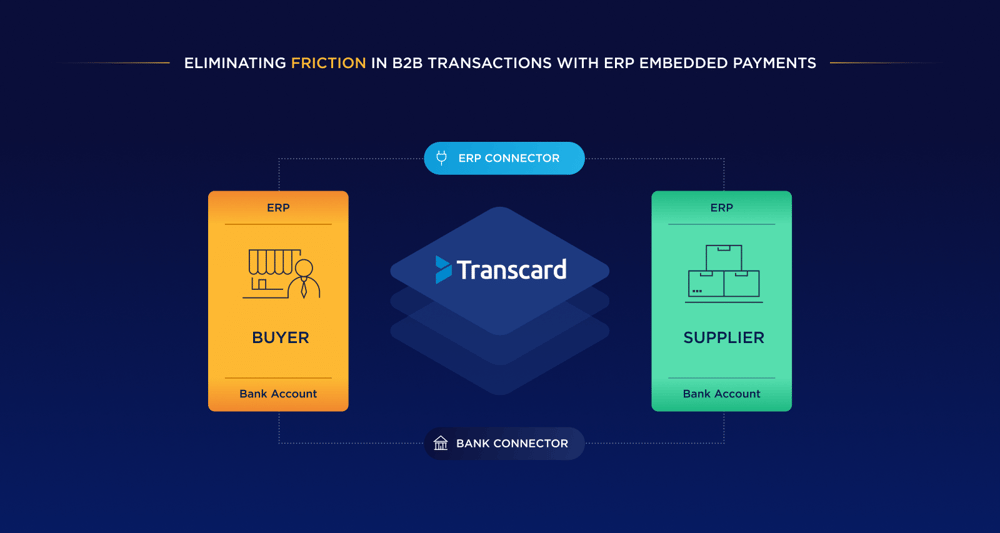

Payment capabilities can now be easily embedded into an enterprise resource planning (ERP) application or software solution, allowing users to disburse or collect payments from within a single system with familiar screens. Payments also can be made or received through a payment network.

Embedded payment solutions combine the best attributes of consumer payment experiences:

- Digital payments

- Self-service capabilities

- Experiences tailored to our needs

- Ease-of-use

- Security

What are the Benefits of Embedded B2B Payments?

Embedded payments and embedded ERP payment solutions are a game-changer for B2B payments:

✔️ Buyers can make and receive electronic payments in the way that works for them.

✔️ A centralized business directory tracks supplier payment terms and preferences.

✔️ Real Time Payment (RTP) and other transaction modalities expedite B2B payments.

✔️ Rich remittance details are uploaded directly to a supplier’s ERP, eliminating the burden of keying data and applying cash and eliminating posting delays that can jam up lines of credit.

✔️ Buyers and suppliers can instantly see the status of payments and historical payment details.

✔️ Payments are reconciled in real-time, streamlining the financial close.

Eliminating friction in B2B payments with embedded payments helps buyers and suppliers reduce inefficient and unnecessarily complex AP and AR tasks, accelerate cash flow, and enhance visibility.

Importantly, embedded payments improve the experience businesses provide their trading partners.

94% of banks and payment service providers, polled for Accuity’s Payments Industry Survey, reported that

"protecting organizational reputation and existing customer relationships" is integral to the payments process. In fact, respondents ranked it as their highest payment priority.

The payments experience may become more important in the future.

Millennials now dominate the workforce. Unlike their older coworkers, millennials grew up in a digital environment where checks and other legacy paper-based processes are antiquated and slow.

Tech-savvy millennials will have little appetite for clunky kluge approaches to B2B payments.

How to Get Started with Embedded B2B Payments

Trading partners are won and lost in large measure on the experience a business delivers.

Businesses that don’t simplify their payments experience will be at a competitive disadvantage.

Embedded payments and embedded ERP payment solutions improve the B2B payments experience for buyers and suppliers. If your business is looking for a better payments experience, Transcard can help.