Making, receiving, and reconciling business-to-business (B2B) payments is extremely inefficient, unnecessarily complex, and risky. B2B payment inefficiencies are a major contributor to:

- Slow and late payments

- Inadequate visibility

- High costs

- Manually-intensive efforts

- Various risk factors

The Barriers to Automation in B2B Payments

Friction in the B2B payments lifecycle can stunt or even stop business growth. Accounts payable and accounts receivable workflows are often plagued with slow and inconsistent processing, data entry errors, and an inability to reconcile payments in a timely or automated manner. Invoicing and payment issues can result in late payment penalties, strained supplier relationships and potential disruption to critical supply chains.

The consequences of late payments can be severe for suppliers, particularly small and mid-sized businesses, potentially putting the business at risk of financial failure, especially for those employing just-in-time models.

The root of the problem is that businesses rely on different systems, processes, and standards for handling B2B payments.

Businesses have been challenged with connecting to each other to allow for touch-free and secure commerce. And the unique logins and passwords, account requirements, file formats, and proprietary integrations for various fragmented competing systems limit opportunities for automation, increase fees, and result in inefficiencies across the B2B payments lifecycle. Making matters worse, many businesses use spreadsheets to manage payment terms and to reconcile invoices.

With tens of trillions of dollars in B2B payments made in North America each year, and pressure mounting on supplies to improve productivity and accelerate Day’s Sales Outstanding (DSO), the stakes are too high for businesses to continue relying on outdated invoicing and payment processes.

A New Vision for B2B Payments

What trading partners need is a way to digitize and simplify the exchange of payments and related data between one another, to reduce costs, complexity, and risks for businesses of all sizes.

That solution is a reality for buyers and sellers, thanks to the Real-Time Payment (RTP®) network and the combination of advanced technologies.

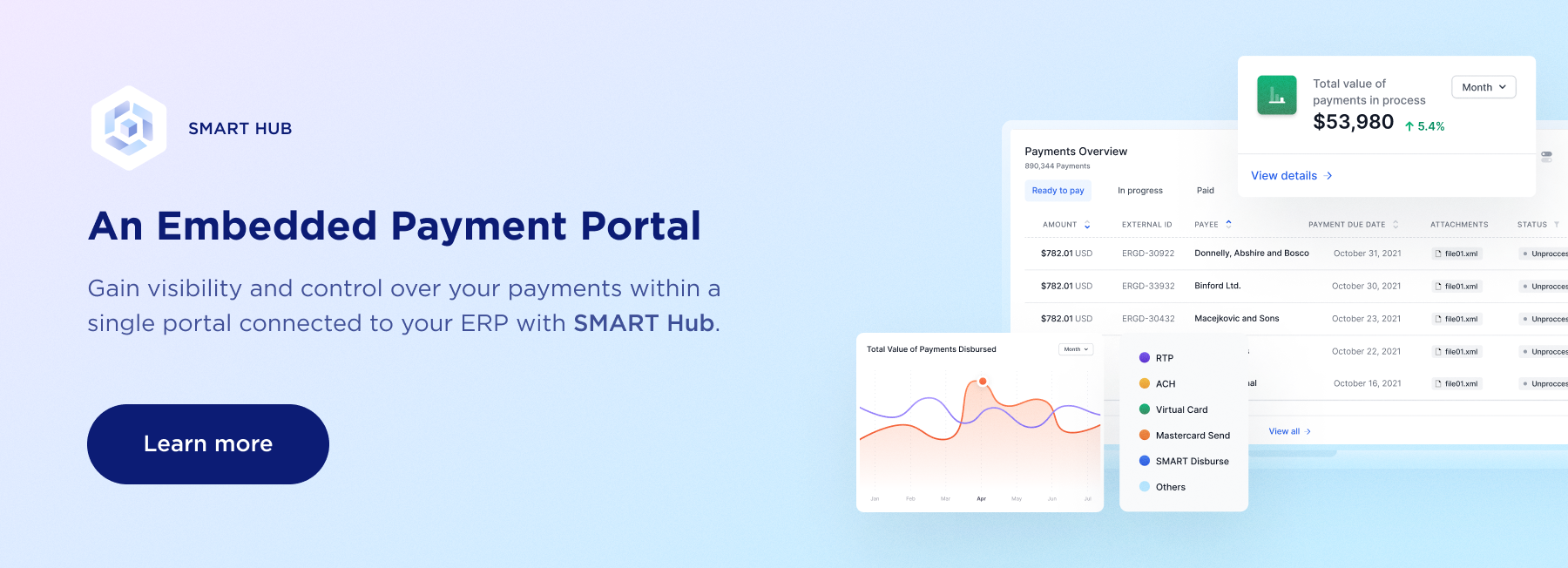

The solution combines RTP Request for Payment (RFP) functionality, accounts payable and accounts receivable invoicing, ERP integration, and payment services onto a single solution.

The RTP network facilitates the immediate transmission and settlement of payments and the exchange of standardized and enhanced remittance data Invoicing capabilities enable suppliers to instantly present invoices via an e-invoice 24/7/365 for initial or recurring bills in their customers’ preferred online or mobile banking channel.

ERP integration connects buyers and sellers and facilitates the exchange of data without the burden of a costly and resource-intensive project. And payment services manage a directory of trading partners, payment terms and preferences, standard reconciliation information, and banking accounts details.

The information typically required to send electronic payments (i.e. the bank routing number and account number) is not always readily available. Payment services remove this barrier to electronic payments.

For buyers and sellers, this means B2B payments and data flows can be fast, transparent, and more secure.

Buyer Benefits

The combination of RTP, invoicing, ERP integration, and payment services for B2B bill payment via the RFP message enables buyers to reduce manual tasks, make more payments on-time, better manage their working capital, reduce supplier inquiries, and eliminate the cost and risk of maintaining supplier banking account data. And buyers can accomplish all this without having to log into a portal or maintaining additional profiles and credentials.

Buyers view the RFP message and any payment-related information and then pay instantly or schedule the payment for future release, thus allowing the full control over the movement of their funds. Once the payment is processed, a final, irrevocable payment is instantly debited from the buyer’s bank account (and simultaneously credited to the seller’s bank account), and both parties are notified that the payment has been made.

Supplier Benefits

Receiving B2B payments via RTP with enhanced data also is advantageous for suppliers. Suppliers receive more payments as scheduled, according to their payment preferences, and accompanied by enhanced remittance data in a standardized format that simplifies reconciliation through automation and reduces the time staff spend logging into customer portals to manage exceptions.

Funds are deposited directly to the supplier’s bank account and the supplier receives an alert via e-mail or text with payment details. And receiving irrevocable payments via RTP reduces returns and exceptions handling.

Make Frictionless B2B Payments your Reality

Now is the time to rethink B2B payments and the underlying cost structure. Treasurers from large corporations and small businesses want to reduce payment complexity.

Modernizing payments also can enhance the customer experience while remaining intuitive and reducing both friction and uncertainty. And payments hold valuable data that can drive financial planning, budgeting, and control and uncover opportunities to increase revenues and profitability.

The combination of RTP, invoicing, ERP integration, and trusted payment services uniquely address the challenges of traditional payment systems, making frictionless B2B payments a reality at last by harnessing the features and functionality of the RFP message.