There was a time when paying your suppliers invariably meant printing and mailing a paper check.

The times are changing, especially for small businesses that use QuickBooks Online.

The percentage of businesses that make at least half of their payments to suppliers using a paper check has declined by seven percentage points over the past three years, according to the Institute of Finance and Management. What’s more, 4% of businesses have completely quit paper checks.

Small businesses that use QuickBooks Online are no exception to the trend towards digital payments.

The shift to remote and hybrid working prompted many businesses to rethink the way they pay suppliers. Adapting paper check printing to a remote work environment is hard, if not impossible.

But the move from paper checks to electronic payments for business-to-business (B2B) commerce started to gain momentum long before the pandemic. Compared to paper checks, electronic payment methods such as Automated Clearing House (ACH) and Real-Time Payment (RTP) transactions cost less, require less intervention, provide better visibility and control, and are less vulnerable to fraud.

By switching to electronic payments, businesses also can automatically reconcile payments in QuickBooks Online in real-time, accelerating the month’s end and year’s end financial close.

The Importance of Accounts Payable

Accounts payable means more in uncertain economic times like these.

Efficient and effective accounts payable processes can help small businesses better manage their working capital, control corporate spending, and forecast their cash flow needs more accurately.

Accounts payable departments put themselves at a disadvantage when they rely on paper check payments to suppliers. Printing and mailing paper checks bogs accounts payable staff down and keeps them growth-generating activities such as data analysis and collaborating with coworkers.

Small businesses cite lots of reasons for dragging their feet on payment automation:

![]() Lack of capital budget

Lack of capital budget

![]() Lack of IT resources to support a project

Lack of IT resources to support a project

![]() Lack of finance department resources to support a project

Lack of finance department resources to support a project

![]() Concerns suppliers won’t accept electronic payments

Concerns suppliers won’t accept electronic payments

![]() Senior management resistance

Senior management resistance

![]() Fear of change

Fear of change

But arguably the biggest barrier to payment automation among small businesses is the difficulty finding the right solution to integrate with their QuickBooks Online accounting software.

Picking the wrong payment solution for QuickBooks Online can set a small business back.

What is Payments Automation for QuickBooks?

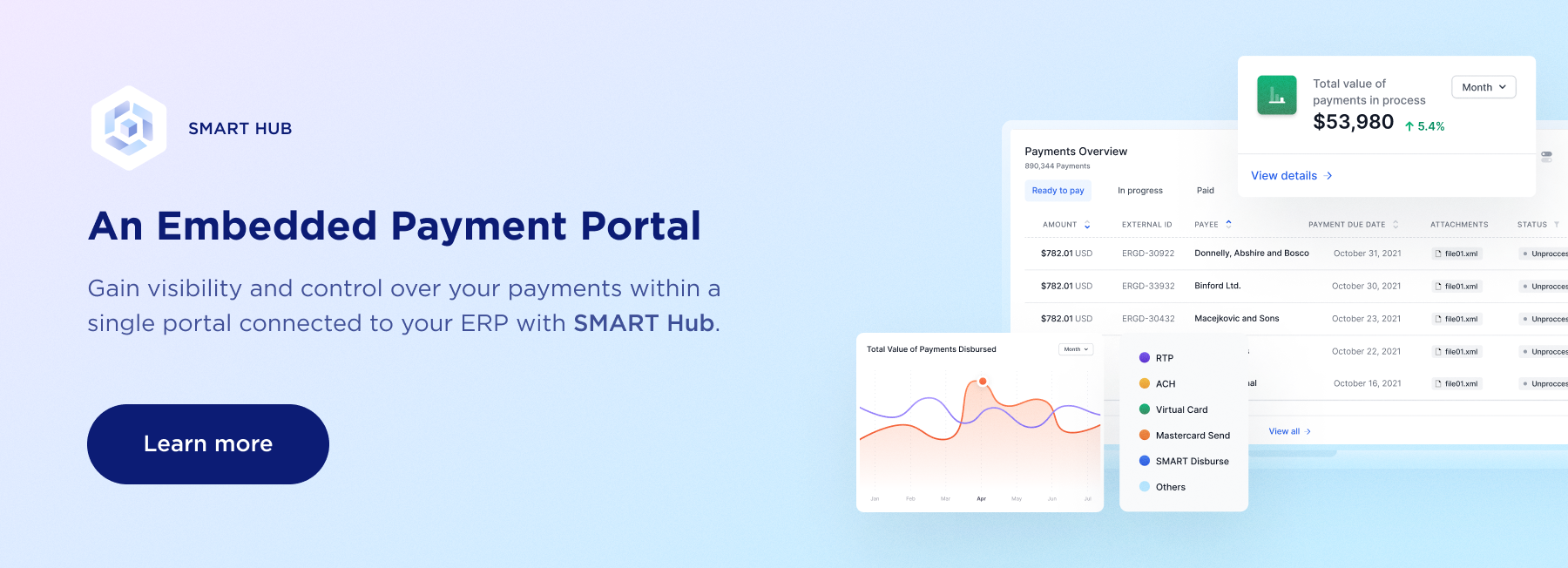

A new breed of payment automation software is making it easier for small businesses that use QuickBooks Online to digitize their disbursements to suppliers. These pre-integrated payment solutions automate the entire payment cycle, from initiation through reconciliation and reporting.

As invoices are approved for payment in QuickBooks Online, they are presented to the pre-integrated payment solution. With a few clicks of the mouse, users can:

Instantly initiate payment on an invoice that’s ready to pay

Schedule the invoice to be paid to terms that exist in the vendor master database

Schedule the invoice to be paid later, when it’s more convenient for the company’s cash flow.

The best pre-integrated payment solutions provide a single platform for QuickBooks Online users to pay suppliers using any payment method, including Automated Clearing House (ACH) transactions, Real-Time Payment (RTP), Account-to-Account (A2A), card, wire, and cross-border payment.

Payments can be initiated from a company’s existing bank accounts, with no need to setup and pre-fund a new account. All payments are automatically reconciled in QuickBooks Online in real-time. And users can see the status of all invoices ready to pay, in-progress and completed payments, and any payment exceptions. Historical payment details can be searched by supplier, date, and amount.

What are the Benefits of Payment Automation for QuickBooks?

Payment automation provides big benefits to QuickBooks Online users.

Reduced Costs. Payments can be made instantly or scheduled for later with just a few clicks of the mouse. No need to print checks, chase down approvals or stuff envelopes.

Improved Staff Productivity. By eliminating manual payment processes, finance staff have more time to focus on growth-generating activities such as data analysis.

Faster Financial Close. Payments are automatically reconciled in QuickBooks Online in real-time without the need to re-key data, make manual updates or maintain a spreadsheet.

Better Scalability. Digitizing and simplifying the payment process enables small businesses to quickly scale their operations to support business growth, without hiring more AP staff.

More Accurate Cash Forecasting. Pre-integrated payment solutions provide small businesses with real-time visibility into their payments, improving their cash forecasting accuracy.

Less Risk of Payment Fraud. Studies show that paper checks are responsible for 10 times as much financial losses from payment fraud as electronic payment alternatives. The best pre-integrated payment solutions offer the same level of security used by leading U.S. banks.

Best of all, the SaaS delivery model for leading payment solutions, combined with their built-in onboarding module, means QuickBooks Online users can get started fast with electronic payments.

These are just some of the reasons that QuickBooks Online users are quitting paper checks.

Start your 90-day free trial of the SMART Hub payment solution for QuickBooks Online today.