Making and receiving payments shouldn't be inefficient, risky, or unnecessarily complex.

The root of the problem that many businesses face when it comes to making and receiving payments is poor integration between payments systems and the ERPs or other legacy applications that they feed.

This problem persists across the B2B and B2C commerce lifecycle.

In fact, poor systems connectivity is a major reason that CFOs, controllers, and finance directors surveyed by the Institute of Finance and Management (IOFM) rank accounts payable and accounts receivable as the two most time-consuming and labor-intensive finance and administrative functions.

The finance executives surveyed by IOFM also believe that accounts payable and accounts receivable are the two finance and administration tasks that would benefit the most from automation.

Deploying another siloed point solution won’t solve the inefficiency gaps in the commerce lifecycle.

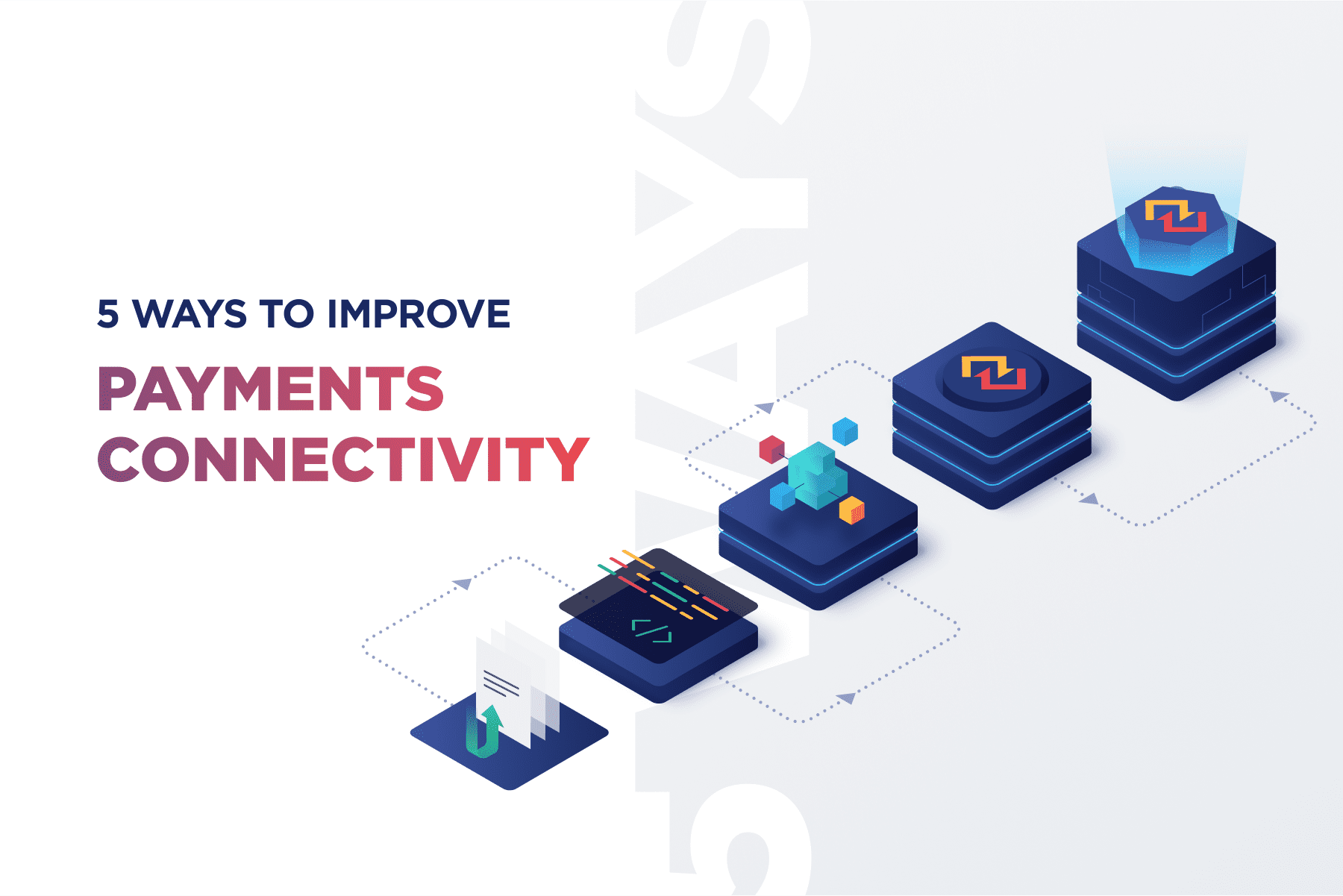

Low to High: Integration Levels for Payments Connectivity

What businesses need is better integration between their payments systems and their business processes.

A new breed of smart payments technology does just that.

It provides hyper-connectivity between systems to eliminate payments friction.

Here's How:

LEVEL 1: File Upload

This no-code approach to payments integration enables businesses to pass payments data between systems and databases without a direct connection and without human operator intervention.

Many payments providers offer file uploads, but smart payments solutions take things to the next level.

This is accomplished by providing a single platform that supports any payment method and including built-in configurable workflows for digitally routing payments and related data for sign-off or exceptions resolution.

LEVEL 2: API Connection

Open payment API integration is another way to digitally connect payment systems with an ERP or legacy system.

An ACH payment processing API makes it easy for businesses to accept ACH transactions.

An ACH API payment also provides the connectivity for better data analytics, and a payment API for developers that speeds up fintech’s time-to-market with expanded capabilities.

Smart payments solutions offer robust APIs with flexibility and agility to adapt to new payment methods and other needs.

Without an API, it can be hard to to keep up with ever-changing payment methods and standards.

Smart payment solutions provide a bank agnostic API connection that won’t lock your business into a single banking relationship that it may outgrow or sour on over time.

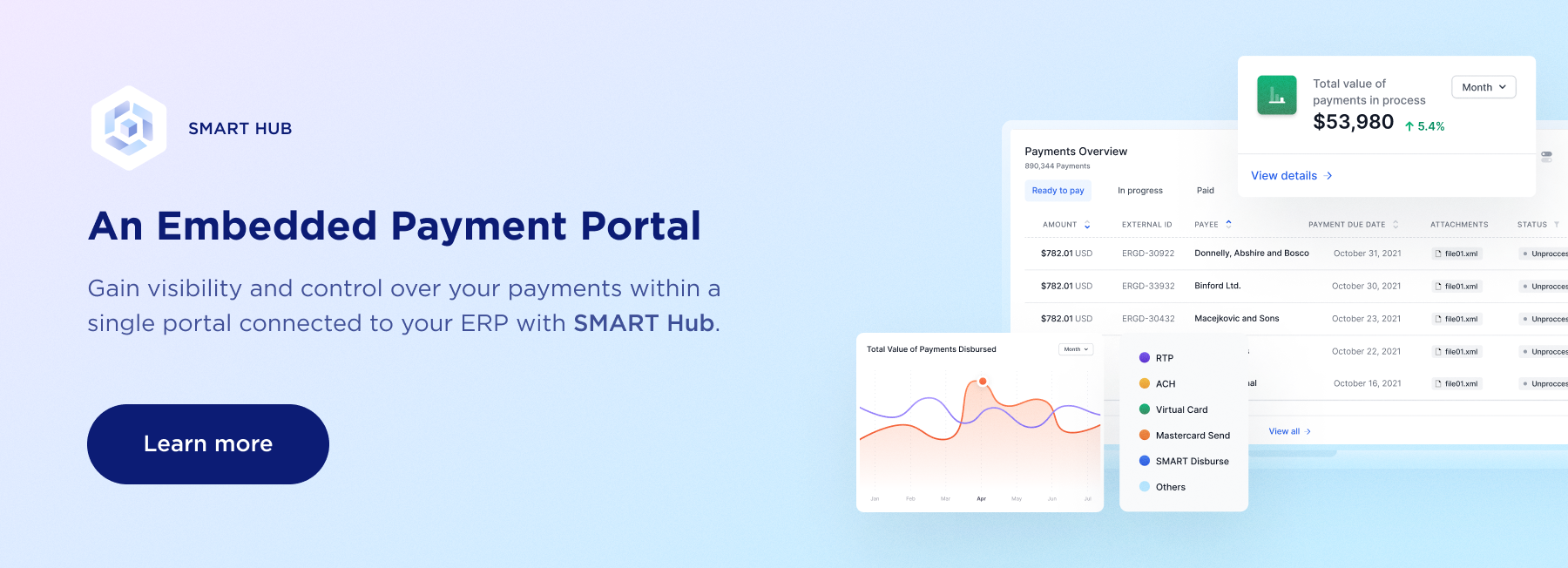

LEVEL 3: Embedded Payments

Most businesses make and receive payments through a jumble of point solutions for procurement, accounts payable, accounts receivable and other financial functions.

Each point solution has its own logins and passwords, account requirements, file formats, and proprietary integrations.

What’s more, many point solutions were designed to support only one payment method, card.

The result is inefficient, error-prone communications, excessive double keying of payments data and other manual tasks, in addition to the need to maintain standalone systems to support all the ways that businesses make and receive payments.

By embedding a smart payments solution with multi-rail capabilities directly into an ERP or legacy system, businesses can initiate payments from a single platform with a familiar user interface.

Data from card transactions or other electronic payments made over the Internet or through a mobile device can automatically flow into a supplier’s ERP or accounting system as sales are made.

LEVEL 4: Account-to-Account Payments Automation

Poorly integrated systems are a major cause of friction across the commerce lifecycle:

invoice printing and presentment

manual invoice approvals

check printing

matching remittances to payments

keying remittance details

applying cash to open invoices

The account-to-account (A2A) integration in smart payment solutions eliminate this friction by directly connecting counterparties through their ERPs:

invoices are presented electronically & approved with just a few clicks from any device

payments & rich remittance detail flow electronically from a buyer to a supplier's ERP

real-time or instant payments replace paying cash upon delivery

digital line-item data exchange eliminates double keying, paper shuffling, & chasing down info

buyers & suppliers know where payments stand in the process

LEVEL 5: A2A Payments with a Centralized Business Directory

What stands in the way of your business migrating to electronic payments?

For many businesses, the biggest barrier to electronic payments is supplier onboarding.

Few businesses have the time or the resources to contact and register every supplier.

Smart payment solutions eliminate this burden by combining A2A automation with an open network of buyers and suppliers and a centralized supplier directory.

Buyers can instantly see suppliers who are registered in the directory, as well as each supplier’s preferred payment method and payment terms.

By connecting buyers and suppliers, the network facilitates frictionless payments while also providing:

data analytics for payments made via the network

storage of sensitive bank account details

bank-grade security for transactions

A Smart Approach to Payments Integration

Whether you are trying to achieve better integrated business processes with ERPs, strengthen multi-bank connectivity, deliver an improved digital banking experience, or access better payment card data analytics, electronic payment integration with your ERP or legacy system may be the answer.

Let Transcard show you how our smart payment solutions can eliminate your payments friction.