Small businesses need every advantage they can get to grow and succeed.

This includes the way that small businesses disburse funds to suppliers.Inefficient and ineffective disbursements can contribute to unnecessary costs, delayed or incorrect payments to suppliers, inaccurate cash forecasting, and heightened risk of payment fraud.

Automating disbursements with a solution that includes a pre-built integration to QuickBooks Online enables small businesses to drive growth by reducing costs and improving cash flow management.

What is Payments Automation?

Paper checks have long reigned supreme when it comes to business-to-business (B2B) payments.

The smaller the business, the higher the percentage of payments they make with paper checks. But payment automation solutions pre-integrated with QuickBooks Online are changing all that.

Pre-integrated payment solutions automate disbursements and streamline the payables process.

By seamlessly connecting with QuickBooks Online, pre-integrated solutions make it easy and secure for businesses of all sizes to disburse payments of any type to suppliers and individuals.

With just a few clicks of the mouse, a user can instantly initiate payment for one or more invoices, approve an invoice to be paid to terms, or schedule a payment to be automatically made later, at a time that is more convenient for the company’s cash flow. Funds can be disbursed using any payment method, including Automated Clearing House (ACH), Real-Time Payment, virtual card, and wire transfer.

Payments are reconciled in real-time with QuickBooks Online or any other system of record, significantly accelerating the financial close at the end of the month or the end of the fiscal year.

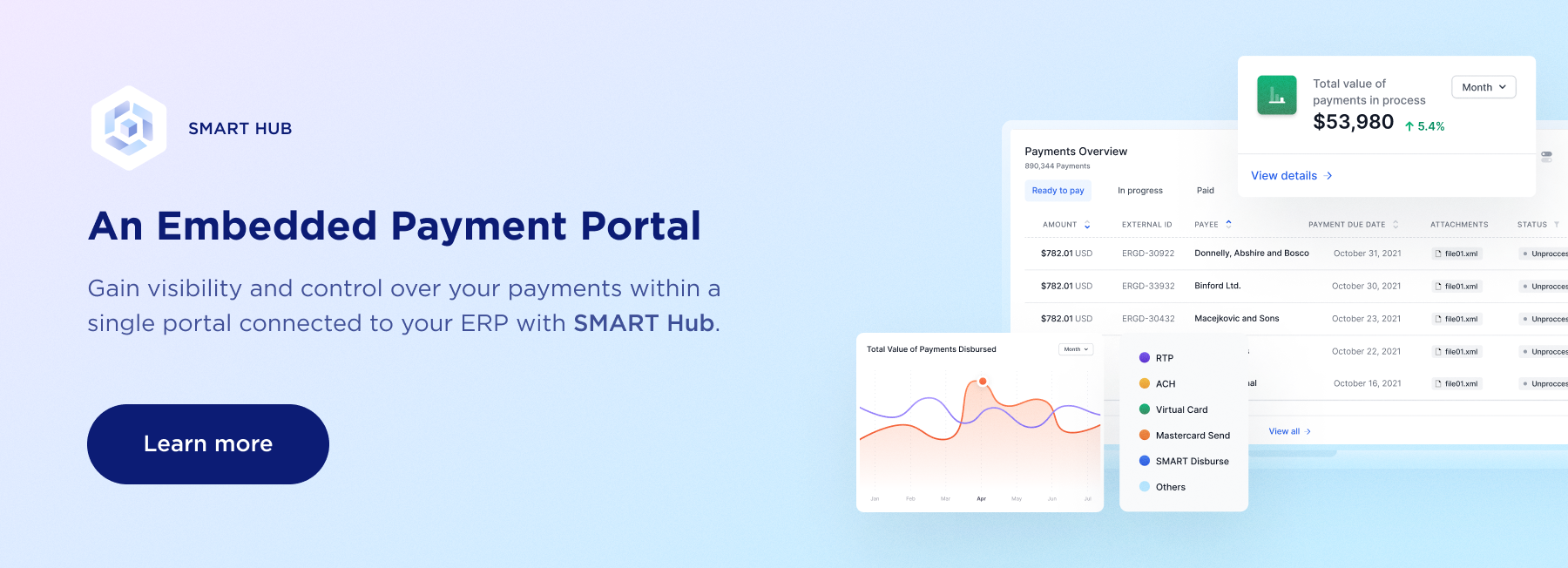

Pre-integrated payment software also enables users to see the status of all invoices ready to pay, in-progress and completed payments, and payment exceptions. Historical payment information can be searched by supplier, date range, and payment amount, with rich payment details clearly displayed.

What is Included in Payment Automation Software?

The best payment automation software digitizes and simplifies disbursements end-to-end.

- Buyer onboarding

- Payment initiation

- Research and reporting

- Reconciliation

Users can initiate payment for a single invoice that’s ready to pay or for multiple approved invoices. Funds can be disbursed to any supplier or individual. And pre-built integrations with bank APIs eliminates the need for businesses to setup and pre-fund a new bank account for disbursing funds.

Digital workflows also can be configured to notify suppliers via email or SMS of approved invoices, securely collect their payment preference and banking details, and confirm their account information.

And pre-integrated payment solutions can easily handle payments to independent contractors.

How Big Does a Business Have to be to Automate its Payments?

Any QuickBooks Online user can automate its disbursements with a pre-integrated payment solution.

The SaaS-based delivery model and built-in onboarding tool used by pre-integrated payment solutions makes it easy for small businesses to get started making electronic payments. Pre-integrated payment solutions can be instantly deployed. The application for leading payment solutions is available in the QuickBooks Online marketplace. And most business connect the software to their legacy systems and bank accounts and complete the onboarding process in a day.

And pre-integrated payment solutions automate disbursements for any industry, including:

- Banking and brokerage

- Insurance

- Property management

- Real estate

- Government and cities

- Freight and logistics

- Manufacturing

- Healthcare and pharmaceuticals

- Consumer packaged goods

- High tech

- Aerospace

- Gaming

The best payment automation solutions for QuickBooks can scale to meet changing business needs.

Key Considerations for a Payment Solution

There are several things that small businesses should look for in an automated payment solution.

- Pre-built integration with QuickBooks Online. Pre-built integrations streamline disbursements, provide better visibility, and automate the reconciliation process.

- Support for any payment method from a single platform. No small business has the time to log into multiple systems or bank portals to initiate different types of payments. And forcing suppliers to accept a particular payment method could strain a valued relationship.

- No need to change bank accounts. Small businesses should not have to setup and pre-fund new bank accounts to disburse funds electronically. Look for a payment solution with pre-built integrations to bank APIs. Leading providers of pre-built payment solutions have integrations with banks representing 60 percent of all U.S. small business bank accounts.

- Ironclad security. Bad actors are seizing on the operational disruption caused by the shift to remote working to perpetrate payment fraud. Leading providers of pre-integrated payment solutions have the same level of security as the largest financial institutions in the U.S.

- Intuitive onboarding. Getting started with electronic disbursements shouldn’t be hard, and it shouldn’t involve lots of IT resources. Look for a pre-integrated payment solution with a built-in onboarding solution that will guide you through connecting QuickBooks Online and your existing depository accounts to the software and submitting necessary information.

- Global payments. More businesses work with suppliers across the world. Leading payment solutions provide cross-border payment options that make global disbursements a snap.

These are some of the things QuickBooks users should look for in a pre-integrated payment solution.

The Benefits of Payment Automation

Automating disbursements can provide big benefits to QuickBooks Online users.

Reduced Costs

A pre-integrated payment solution eliminates manual keying, paper pushing and other manual steps that contribute to higher back-office costs.

Improved staff productivity

With no checks to print or mail or approvals to chase down, finance teams have more time to focus on growth-generating activities.

Better Working Capital Management

Pre-integrated payment solutions make it easy for small businesses to manage the timing of disbursements.

Faster Financial Close

Reconciling payments automating in QuickBooks Online accelerates the month’s end and year’s end financial close for accounting.

These are the types of benefits that growth-minded small businesses need. But they will likely remain elusive without a pre-integrated payment solution.

Learn how digital payments can help your business grow.