Every ISV wants to find ways to generate more revenue from new and existing clients. And helping businesses digitize and streamline their supplier payments is one way for ISVs to do just that.

Few finance functions are as ripe for automation as the way businesses pay suppliers.

Less than one-tenth of accounts payable (AP) departments operate in a digital environment with few or no manual processes, the Institute of Finance and Management (IOFM) reports. Fourteen percent of businesses rely completely on manual approval processes and paper checks to pay suppliers.

The Payment Automation Opportunity for ISVs

Manual, paper-based processes create big headaches for businesses of all sizes.

High costs. Paying suppliers with paper checks cost 30 times as much as ACH transactions, NACHA reports. The cost of check stock, printer toner, postage, and bank fees add up fast.

Inefficiency. Finance teams waste lots of time managing spreadsheets and double-keying information to manually reconcile paper checks with bank statements. The process of reconciling paper checks is so onerous that it can delay when a business closes its books.

Slow cycle times. It can take seven to 10 days to get a paper check into the hands of a supplier. Service reductions by the U.S. Postal Service are slowing things down further.

Poor visibility. You can never be sure where a check payment is once it gets dropped in the mail. It’s not uncommon for checks to become lost in the mail or misplaced by a supplier.

High risk of fraud. Paper checks are responsible for 10 times as much payment fraud as ACH transactions, NACHA finds. It’s easy for bad actors to intercept checks in the mail.

It’s no wonder that:

71% of AP leaders surveyed by IOFM say their department has plans to automate the way their business pays its suppliers.

44% of AP leaders who describe their process of paying suppliers as being “largely automated” have plans to automate further.

The Payments Automation Challenge

But migrating from paper checks to electronic payment is easier said than done for most businesses.

Concerns about supplier adoption. More suppliers want to be paid electronically. But finance pros know that suppliers don’t want to be forced into accepting one type of payment, such as card. That’s what happens with many electronic payment solutions providers.

Fear of change. Economic uncertainty and the operational disruption caused by the shift to remote working has resulted in finance pros shouldering a heavier load. The last thing they want is a complicated new system to learn that will disrupt proven and established processes.

Trepidation about a complex deployment. Businesses have invested lots of time and money in their ERP, accounting software, and systems of record. They fear that they won’t have access to the IT resources they need to integrate a payments solution with these systems.

Reluctance to disrupt existing bank relationships. Businesses don’t want to be forced into setting up and continuously pre-funding a new bank account to make electronic payments.

Lack of senior management support. Senior management is taking a critical eye to all automation projects these days. Finance leaders know it’s hard to win approval for any automation proposal that doesn’t deliver a compelling return on investment (ROI).

ISVs that can help businesses overcome these barriers to electronic payments adoption will be well-positioned to attract and retain clients that want to migrate from paper checks to electronic payments.

How Embedded Payments Help

Embedded payment solutions – SaaS-based systems that are pre-integrated with ERPs or accounting software – provide ISVs with the technology they need to win business in the payments space.

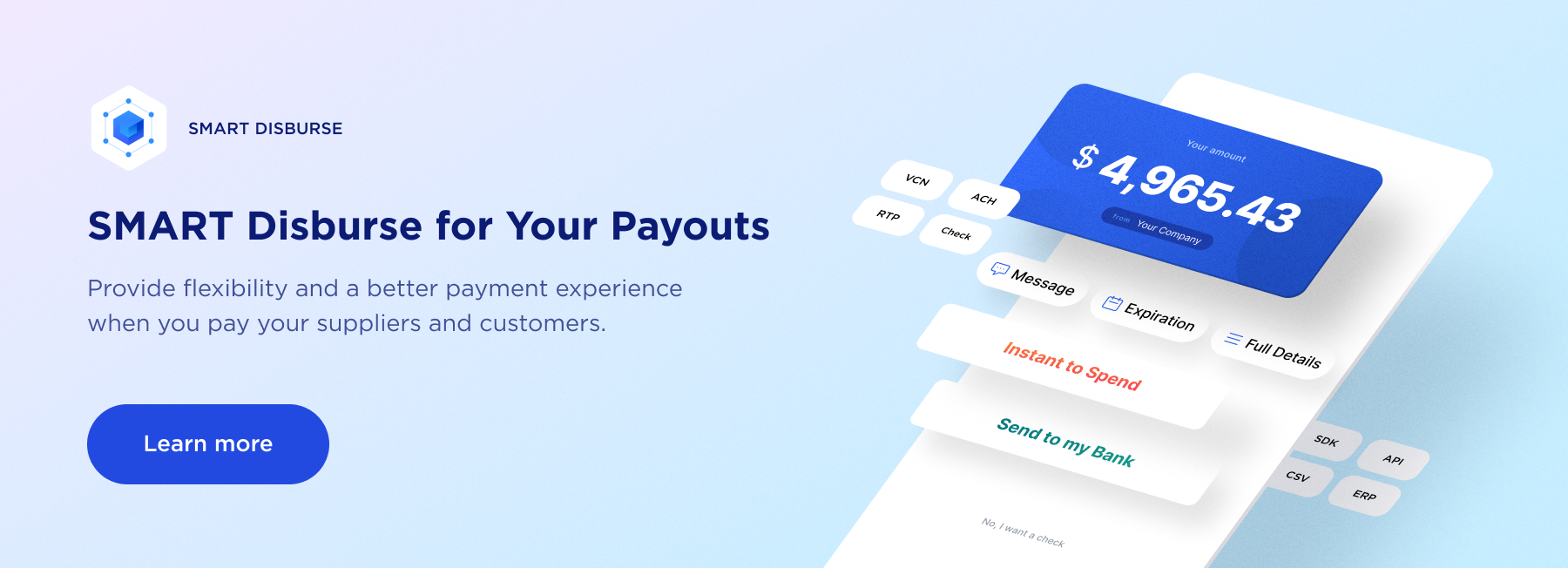

Payment options. Embedded payment options make it easy for businesses to pay suppliers in their preferred method. Some payment methods can even be settled within minutes and made on weekends, holidays, and after hours. Embedded payment solutions also ensure that payments are deposited directly into a payee’s bank account as scheduled, so there’s no need for special trips to the bank or calls or emails to customers to check on the status of things. There also is no chance that electronic payments will be lost in the mail or misplaced.

Ease of use. With an embedded payment solution, users can initiate or schedule one or more payments with just a few clicks of the mouse. Approved invoices also can be automatically scheduled for payment before the negotiated due date in the vendor master database. The technology also eliminates the need for users to log into multiple payment systems or bank portals to make different types of payments. Complete remittance details are automatically generated and sent to payees. And payment data is automatically synchronized with the payor’s ERP or accounting software in real-time, without users having to double-key data.

Seamless integrations. Embedded payment solutions seamlessly connect with any legacy ERP application, accounting software, or other systems of record, including those from QuickBooks, Sage, and Acumatica. Pre-built digital payment workflows for industries such as insurance, healthcare, and real estate help businesses meet unique processing needs.

Bank connectivity. Embedded payment solutions don’t require businesses to set up or prefund new bank accounts to pay suppliers electronically. The technology connects to bank APIs to enable businesses to initiate payments of any type from any existing bank account.

Improved cash management. Working capital means more to business leaders in times like these. Embedded payment solutions enable businesses to better control payment timing. Funds can be disbursed instantly, paid to terms, or scheduled when it is most convenient for a payor’s cashflow.

Graphical dashboards display important cashflow metrics such as the total value of payments in progress and the value of payables ready to pay by supplier. Historical payment data can be effortlessly searched to uncover cashflow trends. And built-in supply chain financing speeds cashflow to suppliers without impacting the payor’s balance sheet.

By simplifying the migration to electronic payments with an embedded payments solution that includes these features and functions, ISVs can tap into the growing demand for AP automation.

Simplify the Payments Migration

The rising demand for AP automation is a golden opportunity for ISVs to increase revenues.

By leveraging an embedded payment solution that overcomes the most common barriers to automation, ISVs will be equipped to help new and existing clients automate their payments.