Paying suppliers electronically has become a top priority for accounts payable (AP) departments.

Since the start of the pandemic, the percentage of AP departments that make most of their payments to suppliers via paper check has declined by seven percentage points. Incredibly, 4% of AP departments have completely quit paper checks – they pay all their supplier invoices electronically.

These statistics from the Institute of Finance and Management (IOFM), an AP trade association, make it clear that paper checks are finally losing their grip on B2B payments.

The Benefits of Paying Suppliers Electronically

There’s no question that the shift to remote working accelerated the push towards electronic B2B payments. When government health restrictions during the pandemic prevented AP teams from getting into the office to cut paper checks, departments had to find other ways to pay suppliers.

But businesses began to embrace electronic payments long before the pandemic. Compared to paper checks, Automated Clearing House (ACH) transactions, real-time payments, virtual card payments, and other electronic payment options offer tantalizing benefits to businesses of all sizes:

Reduced Costs

Paying suppliers with paper checks require businesses to pay money for paper, postage, and printer ink. Some businesses also pay bank fees for positive pay services. When a check becomes lost in the mail or misplaced by a supplier, AP departments must also pay fees to stop payment and reissue the check. These seemingly small costs add up fast.

Faster Cycle Times

It can take seven to 10 days to get a paper check into the hands of a supplier, when you account for all the time required to print, approve, and mail a check. One or more electronic payments on approved invoices can be initiated with just a few clicks of the mouse. And real-time payments can settle within moments of being initiated.

Enhanced Visibility

Suppliers can never be sure when a paper check will arrive in the mail. And reductions in U.S. Postal Service delivery schedules are making things less certain. Electronic payments provide real-time visibility into the status of all ready-to-pay, in-process, and completed transactions. Suppliers also can rest easy knowing that an electronic payment will be deposited directly into their bank account on the date that the payor said it would.

Cash-Back Opportunities

Businesses can earn cash-back rebates on payments made to suppliers via virtual card. The money that businesses earn from these rebates can offset an AP department’s overhead. Businesses don’t earn rebates on paper check payments.

Reduced Risk of Fraud

Paper checks are responsible for 10 times as many payment fraud losses as ACH payments, NACHA reports. It’s easy for bad actors to intercept checks sent through the mail and “whitewash” them for deposit into an account that they control. Best-in-class electronic payment solutions leverage a bank-grade security infrastructure and comply with credit card industry standards for safeguarding cardholder information.

These are some of the reasons that AP departments are enthusiastically adopting electronic payments.

How to Automate Your Supplier Payments

That’s not to say that every business is embracing electronic payments.

The smaller your business, the higher the percentage of payments you are likely to make using paper checks, IOFM finds.

6% of AP leaders say their department has no plans to migrate away from check payments.

Businesses cite several reasons for dragging their feet on digital payments:

- Lack of IT resources

- Lack of capital budget

- No senior management support

- Concern that existing systems won’t support electronic payments

- Concern that suppliers won’t accept electronic payments

- Fear of change

Best-in-class electronic payment solutions help businesses of all sizes overcome these obstacles.

Fast and Easy Deployment

SaaS-based payment solutions can be deployed within moments with minimal IT involvement and without disrupting existing business processes. Pre-built integrations with popular ERP applications and accounting packages such as QuickBooks, Acumatica, Sage Intacct, and SAP Business One remove technical complexity.

There’s also no need to set up a new bank account to fund transactions. An online onboarding module guides finance pros through the process of setting up the solution. And SaaS-based payment solutions don’t require any upfront capital investment or the purchase of expensive hardware.

Ease of Use

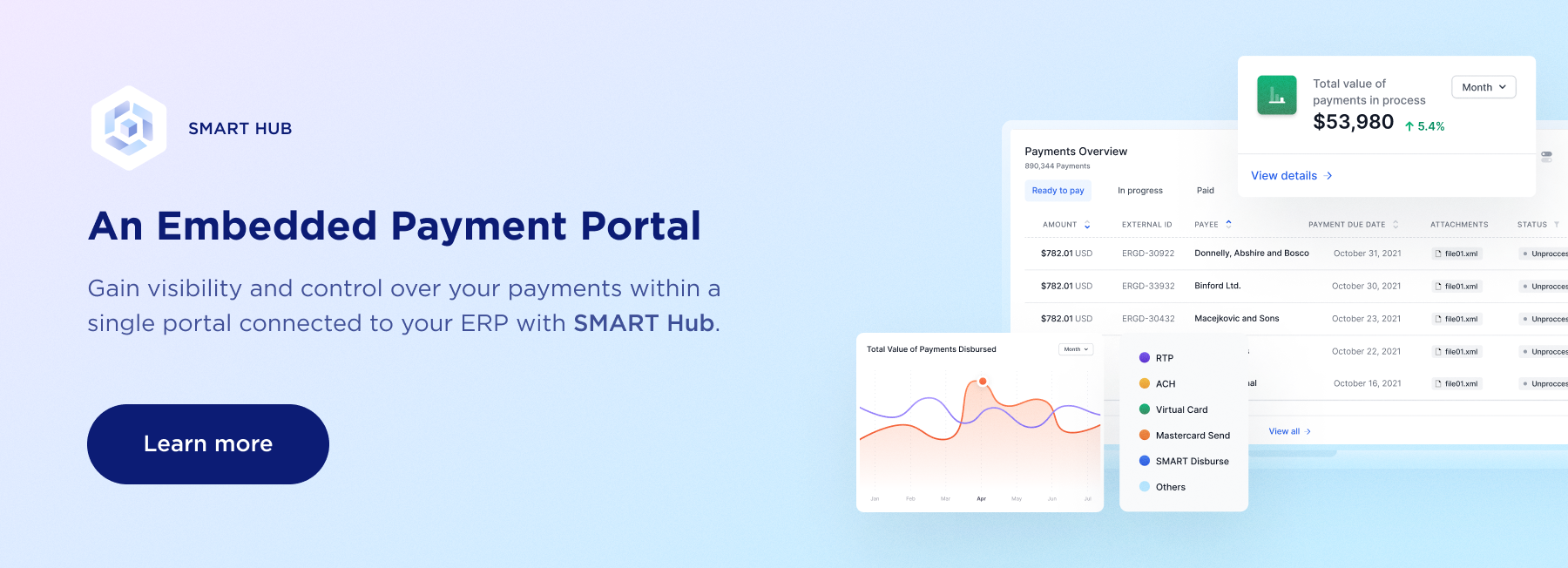

Best-in-class payment solutions are easy to learn. A single platform supports any type of payment, including ACH, real-time payment, virtual card, and Mastercard Send. Users can instantly make or schedule one or more payments with just a few clicks of the mouse. And the technology can automatically schedule approved payments to be made before their due date if payment terms exist in the payor’s vendor master database.

Streamlined Processes

Managing all payments from a single portal eliminates the need to log into multiple systems. Payment data is reconciled in real-time and synchronized with the payor’s ERP application or accounting package without the need for double-keying or spreadsheets. Details on any payment exceptions are instantly available and payments can be re-processed with a single mouse click. AP staff also can instantly check the status of any supplier payment or search historical payment information, all from a single location.

Enhanced Cash Management

Execs are sure to love the improved cash management that comes with automating supplier payments. Payments can be made instantly, paid to terms, or scheduled when it’s better for the company’s cash flow. Faster payments create more opportunities to capture early-payment discounts. Metrics such as the total value of all in-process payments and the value of payables real-to-pay by the supplier are instantly available.

Choosing an automated supplier payment solution that combines these attributes will help ensure that a business of any size achieves the full benefits of paying its suppliers electronically.