The global fintech software market is growing fast, and is expected to reach $15.7 billion by 2022.¹ The main drivers of this growth are the need for financial institutions to optimize costs, boost revenues, and improve the customer experience.

While many types of software have been released to meet different needs of financial institutions, much of the current fintech software has been designed to increase revenue and improve customer relationships for banks and credit unions. Here are four of the best options.

Top 4 FinTech Software Solutions

1. Loan Software

Global peer-to-peer lending, valued at 3.5 billion in 2013, is expected to grow dramatically, reaching a total market value of one trillion dollars by 2025.² Managing this explosive growth in alternative lending will be a challenge for financial institutions, and one in which fintech will play a key role.

To help financial institutions keep up, alternative lending management software is being designed to improve the customer experience by being fast and user-friendly. It can also increase FI revenues with automation and efficiency tools that help bring in and approve loans faster.

Loan software may be targeted at loan origination, which can improve the process through automation; credit bureau integration; and fraud detection - all of which help to speed the review and approval process for enterprise and customer alike.

New fintech software is also being applied to the loan underwriting and risk-assessment process, using data analytics to predict the likelihood of timely repayments; to commercial loans, and to new loan products such as student loans, factoring loans, business and personal lines of credit, and invoice financing.

2. Funds Disbursement Software

Funds disbursement platforms are becoming more popular for individual and enterprise clients alike. The global value of digital transactions is expected to more than double from 2016 to 2022, reaching $5.7 trillion USD.³

Funds disbursement software is becoming more popular among financial institutions because they have several applications. For retail customers, financial disbursement platforms act as a base for debit or prepaid card programs, for example. The card program helps financial institutions create new revenue streams by introducing new products and expanding their relationship with retail customers.

Funds disbursement platforms can also be white labeled and resold to enterprise customers. With white labeling, FIs provide business customers with a suite of online payment solutions, traditional check, and ACH payments for use in payroll, B2B payments, and other disbursement needs.

In both retail and business application, funds disbursement platforms allow FIs to increase their product offerings, building relationships with customers and increasing revenue.

3. Self-Service Online Banking Software

Online banking is the preferred method of financial management for customers, particularly millennials, 71 percent of whom⁴ said that they would rather go to the dentist than visit a bank in person.

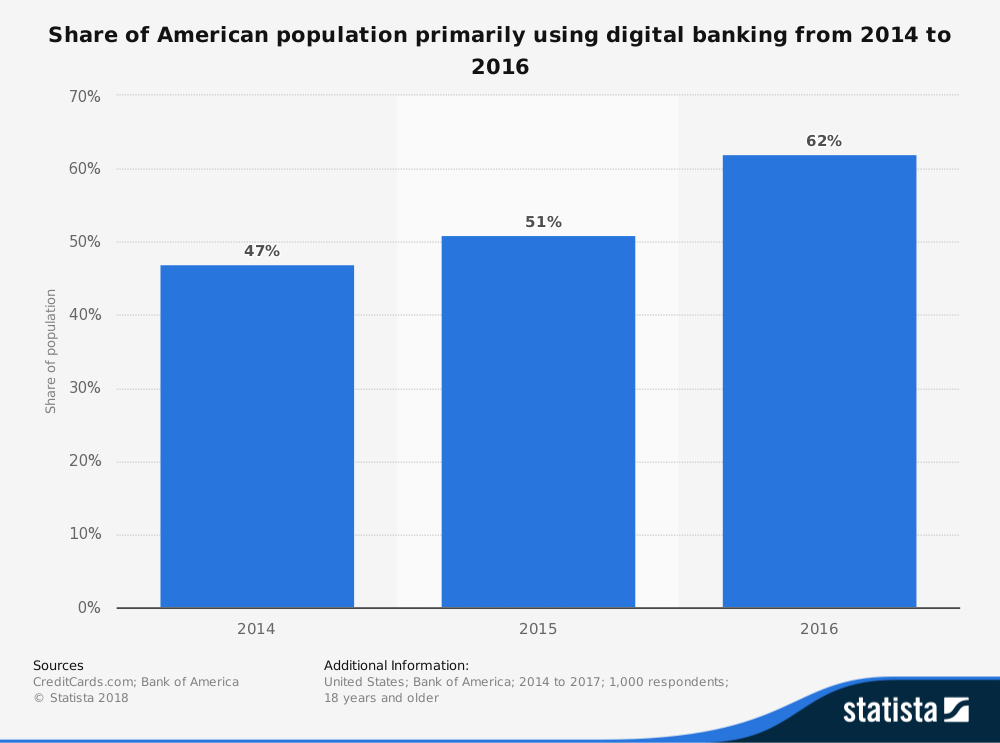

In fact, the number of individuals that primarily use digital banking increased from 47 percent in 2014 to 62 percent in 2016.⁵

Online banking offers the convenience of 24/7 access, notifications and instant messaging to help customers manage their personal finances, and reporting that helps security monitoring and fraud prevention. If you haven’t already invested in online banking software, it’s past time to implement the solution for your financial institution.

4. Secure Payment and Billing Software

The global payments market is expected to continue to grow to over one trillion dollars by 2019.⁶ That’s created risks for security, which has led to fintech software that uses advancements in biometrics, webcam IDs, and blockchain to create new options for secure billing and payments for clients.

These new techniques improve the customer experience, as offering different options makes billing and payments safer, more convenient, and customizable for individual and enterprise customers. It also helps to generate new revenues for financial institutions, as payments-as-a-service or billing-as-a-service can be offered to customers as an upgraded service level, creating new revenue streams for the bank or credit union.

Find a FinTech Platform that Expands Your Offers

The fintech software market is expanding rapidly and changing frequently, offering many opportunities for financial institutions to improve revenue and customer relationships.

Financial institutions should take advantage of these opportunities, applying fintech to improve loan offerings, streamline funds disbursement, and provide more online payment solutions for customers. Selecting the right platform to expand and enhance your offers is an important step for institutions hoping to increase their competitive advantage in the global marketplace.